If a merger or acquisition was planned before receiving Phase 4 General Distribution payments, will health care providers still need to report these activities? (Added 10/26/2021) If a Reporting Entity that received a Phase 4 General Distribution payment undergoes a merger or acquisition during the Period of Availability, as described in the Post-Payment Notice of Reporting Requirements, that corresponds to the Payment Received Period, the Reporting Entity must report the merger or acquisition during the applicable Reporting Time Period

What type of review will HRSA do after a merger or acquisition has been reported by recipients of a Phase 4 General Distribution payment? (Added 10/26/2021) If a Reporting Entity that received a Phase 4 General payment indicates when they report on the use of funds that they have undergone a merger or acquisition during the applicable Period of Availability, this information will be a component that is factored into the entity’s audit risk score.

If a merger or acquisition was planned before receiving ARP Rural payments, will health care providers still need to report these activities? (Added 10/26/2021) If a Reporting Entity that received an ARP Rural payment undergoes a merger or acquisition during the Period of Availability that corresponds to the Payment Received Period, the Reporting Entity must report the merger or acquisition during the applicable Reporting Time Period.

What type of review will HRSA do after a merger or acquisition has been reported by recipients of an ARP Rural payment? (Added 10/26/2021) If a Reporting Entity that received an ARP Rural payment indicates when they report on the use of funds that they have undergone a merger or acquisition during the applicable Period of Availability, this information will be a component that is factored into the entity’s audit risk score.

If a provider received Provider Relief Fund payments and ARP Rural payments, can they use these payments for the same eligible expenses or lost revenues? (Added 10/26/2021) No. A provider may not use an ARP Rural payment to cover eligible health care expenses or lost revenues attributable to coronavirus or COVID-19 if the provider has already reported that Provider Relief Fund payments have covered the eligible expense or lost revenues. If a provider receives both types of funding, the provider should apply Provider Relief Fund payments toward eligible health care expenses and lost revenues attributable to coronavirus before utilizing ARP Rural payments to cover eligible health care expenses and lost revenues attributable to COVID19.

How will HRSA treat prior payments received from the Provider Relief Fund when calculating the Phase 4 Base Payment amount? (Added 10/26/2021) HRSA will deduct from the Phase 4 Base Payment any prior Provider Relief Fund payments received by the applicant and any of its subsidiaries/billing TINs included in its Phase 4/ARP Rural application, which were not previously deducted from the Phase 3 General Distribution payment. The Phase 4 deductions include any prior Provider Relief Fund payments that exceeded 2% of annual patient care revenue or 88% of changes in operating revenues and expenses for the first half of calendar year 2020. For example, if an entity applied to Phase 3 after receiving $100,000 in prior Provider Relief Fund payments, including a General Distribution payment that was equal to 2% of annual patient care revenue, and reported a change in operating revenues and expenses in the first half of 2020 that equaled $75,000, then the entity did not receive a Phase 3 payment. In Phase 4, the remaining $25,000 that was not yet deducted will be taken into account when calculating the Phase 4 Base Payment amount.

Why is HRSA requesting that applicants include all its billing TINS in the Phase 4/ARP Rural payments application portal? (Added 10/26/2021) Applicants must include all billing TINs under the filing TIN that provide patient care to ensure that applicants receive the maximum payment amount for which they are eligible. Applicants must include an exhaustive list of TINs and must ensure that all TINs included in the application belong to the filing TIN that is applying. HRSA will calculate the ARP Rural and a portion of Phase 4 payments based on the submitted billing TINs, as well as assess eligibility for ARP Rural payments for each of the included billing TINs.

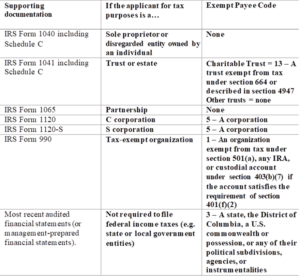

What “exempt payee code” should I select when registering in the application portal? (Added 10/26/2021)

Applicants should select the exempt payee code based on the following information:

For reporting net patient revenue, do providers need to exclude prior year cost reports settlements? (Added 10/26/2021) No. Providers do not need to exclude prior cost report settlements when reporting patient care revenue in the Phase 4 application. Providers may use actual settlements received or their historical information to estimate the amount of cost report settlement, in line with their internal processes and procedures.

Why is HRSA requesting applicants select a provider type? (Added 10/26/2021) HRSA will employ several pre-payment risk mitigation and cost containment safeguards to ensure that application information is accurate and that HRSA is making payments equitably, including adjusting payments based on self-selected provider type, as described in the payment methodologies available at https://www.hrsa.gov/provider-relief/future-payments/phase-4-arprural/payment-methodology. HRSA will determine provider type adjustments after all applications are received. Please note, if an application is flagged, HRSA will conduct a review of the associated supporting documentation. Depending on the results of the review of the documentation, the potential payment for the application may be adjusted based on provider type-based adjustments.